Five Facts to Know for Life Science Leaders Before the Summer Break in Brussels

At a Glance

European Union elections just took place. The 2019–2024 EU institutional mandate is coming to an end. A new mandate is upon us. What does this mean for EU health policy? For the life sciences industry? And more importantly, what should life science leaders do about it?

This analysis is intended for leaders within the life sciences industry as a “need to know” before the summer break. We explore what this once-in-a-five-year institutional transition means for life science companies, and what can be done in the coming months to help shape health policy in the EU.

1. HEALTH HAD A GOOD RUN IN THE LAST MANDATE,

BUT RUNS RISK OF NEGLECT IN THE NEXT

Health had an unprecedented spotlight in the previous EU mandate, largely driven by the COVID-19 pandemic. We also saw initiatives such as Europe’s Beating Cancer Plan, EU action on mental health, the European Health Data Space, the creation of the European Health Union, and of course, the revision to the legislation for medicines in the EU (a.k.a. “the Pharma Package”). The latter of which—despite progress in the Parliament—is far from done.

A recent Eurobarometer survey indicated that health is a priority for citizens; however, signals from the EU institutions hint towards less focus on health in the next mandate, notably:

- There were few high-profile references to health in the European Parliament election campaigns, featuring neither prominently in debates, nor in manifestos.

- The updated Multiannual Financial Framework (MFF) recently saw a reduction in the health budget.

- The new Council Strategic Agenda does not feature health as a core priority; however, it does point towards a stronger focus on research and innovation in key technology areas including health, pharma, and biotech.

Looking to the next mandate, life sciences leaders should keep in mind that many health stakeholders will be calling on policymakers to support their specific causes in health, especially in light of the diminished interest in health mentioned above. Consequently, this space will get very crowded, very quickly. Therefore, life science leaders should engage beyond the usual health topics by “hooking” their key policy asks onto emerging areas of focus, such as health security, for example.

This could be complemented by framing the contributions of the life sciences industry to the twin topics of a) competitiveness and b) strategic autonomy in the EU. There is an opportunity to place a greater emphasis on regional independence and economic growth in the next mandate. Both of which are linked to maintaining and strengthening the critical life sciences industry infrastructure in the EU.

2. THE EU ELECTIONS RESULTED IN A SHIFT TO THE RIGHT, POTENTIALLY LEADING TO SLOWER, OR LESS AMBITIOUS, EU COORDINATION ON HEALTH

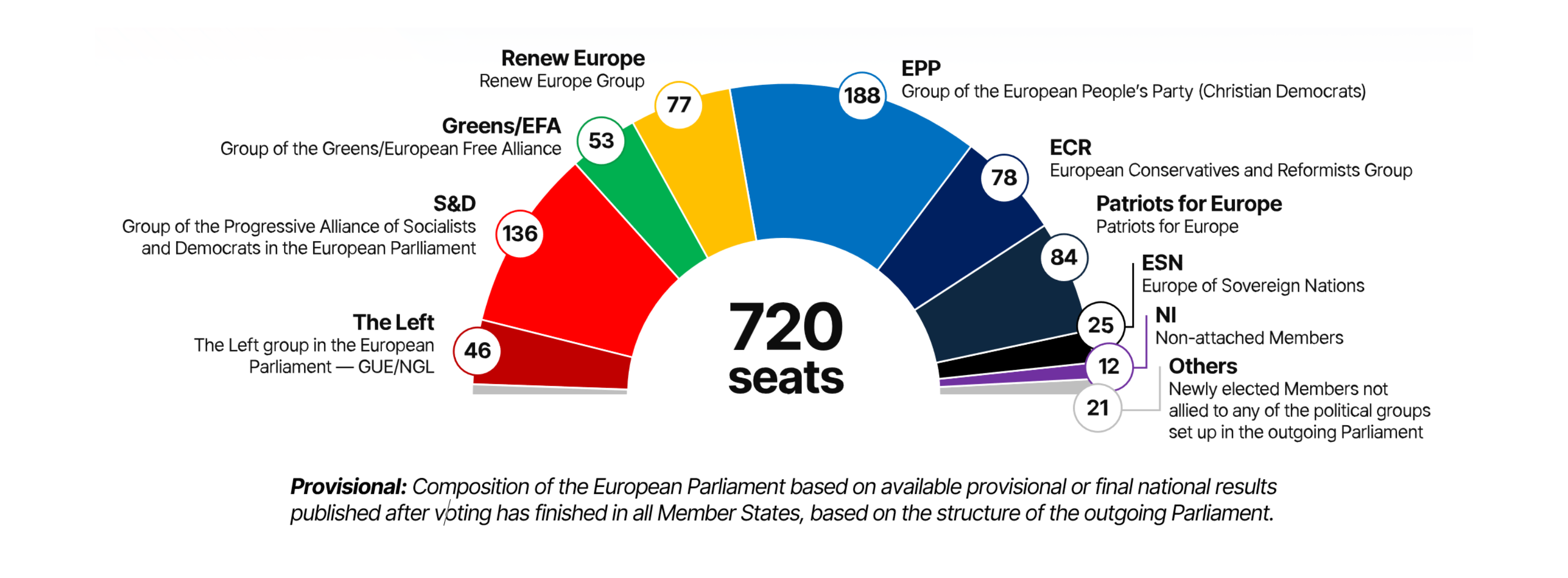

The recent elections held from June 6–9, 2024 resulted in a shift towards the right (as predicted). Those on the right, such as the European Conservatives and Reformists (ECR) group, believe the EU should play only a complementary role in health, leaving regulatory frameworks, fiscal policies, and healthcare system management to individual Member States.

Consequently, progress on health issues may be slower and less ambitious in the next mandate. Centrist parties like the Socialists and Democrats (S&D), the European People’s Party (EPP), and Renew Europe still hold a majority (also as predicted), which should temper the far-right influence. A Group on the extreme right was recently formed comprising 25 MEPs (Europe of Sovereign Nations — ESN), alongside the Patriots for Europe (PfE), who have 84 members.

The new Parliament will not be entirely disinterested in health, as parties like S&D and EPP did highlight some key points in their manifestos; The Left, Greens, and Renew Europe to a lesser extent. EPP, S&D, and Renew Europe have further elaborated their post-election priorities, highlighting the European cancer strategy, cardiovascular prevention, and other key initiatives. The general consensus seems to focus on addressing inequalities, improving healthcare access, and prioritizing mental health. More specifically, EPP and Renew Europe advocate for an innovative industry, with EPP aiming to make Europe “the pharmacy of the world” and Renew Europe supporting the Critical Medicines Act. S&D calls for a holistic HealthFirst Act. For the Pharma Package (for which we await a Council position on), given that an official Parliament position was recently reached, the new Parliament is unlikely to change this position, but it can still influence negotiations with the Council, potentially causing delays.

The question will undoubtedly arise as to whether life science companies should engage with the far right during the next mandate. This is a complex topic, and there’s not always a single blanket response to this question. It should be dealt with on a case-by-case basis, in particular if life science companies do not have a global or regional position on the matter.

3. A NEW MANDATE OFFERS OPPORTUNITIES TO CREATE NEW “HEALTH CHAMPIONS” AND RALLY THE RETURNING ONES

Several MEPs with a track record in health were not re-elected, including those working on substantial health files such as the Pharma Package. Uncertainty surrounds others who await final confirmation at national level before knowing if they can return. Despite these changes, other health “champions” remain, including the (co)rapporteurs from the Pharma Package, Tiemo Wölken (S&D, Germany), Nicolás González Casares (S&D, Spain), Katerina Konečná (The Left, Czechia), and Tilly Metz (Greens/EFA, Luxembourg).

To maximize the number of potential “champions” for life science topics in the new Parliament, life science leaders should ensure resources are in place to map and engage new members with a track record (or interest) in health as soon as is possible.

This could be complemented by mapping and engaging with new and returning MEPs who represent key constituencies where life sciences companies have a significant footprint. For example, in constituencies where companies are headquartered, where large R&D and manufacturing sites are based, or where biotech hubs are located.

4. THE COUNCIL, COMMISSION, AND INSTITUTIONAL TRANSITION ITSELF PROVIDE WINDOWS OF ENGAGEMENT AND INFLUENCE

The once-in-a-five-year EU institutional transition doesn’t end once the elections are over. It’s a complex interplay with other institutions, notably the European Council (the institution that provides overall guidance for the next mandate) and the European Commission (the institution who implements and executes).

The Council recently published its Strategic Agenda, which will serve as a roadmap for the Union’s activities over the mandate, offering clear political direction and priorities to address current and future challenges. As mentioned above, this new Strategic Agenda points towards a stronger focus on research and innovation in key technology areas, including health, pharma, and biotech. Under the Belgian Presidency, the June 2024 Council Conclusions urged the Commission to keep health at the top of the agenda, tackling workforce shortages and supply security. They also called for better investment tools and action to prevent diseases. The current Hungarian Presidency aims to present Council Conclusions on cardiovascular diseases and organ donation, while continuing negotiations on the Pharma Package.

Life science companies could leverage both their pipeline of innovative assets, as well as their geographical footprint on EU soil to demonstrate commitment to the EU’s a) strengthened competitiveness, and b) strategic autonomy of the sector.

Life science leaders should consider the full spectrum of engagement and influencing opportunities over the coming six to twelve months of institutional transition. This also includes engaging at the national level, capitalizing on company footprints in key markets. This is particularly true for files like the Pharma Package. There are also opportunities to engage in upcoming processes related to the appointment of new Commissioners and the focus of their missions, development of the Commission’s Work Programme for 2025, and ensuring there’s adequate funding for health in the EU’s budget.

5. NOW IS THE TIME TO TAKE ACTION TO ENSURE THE EU FRAMEWORK SUPPORTS THE INDUSTRY IN THE NEAR FUTURE

Looking beyond immediate items of concern, there’s an opportunity to plan, anticipate, and mitigate forthcoming issues on the horizon—including through a non-healthcare lens. On that note, the European Commission recently tasked former Italian Prime Minister Enrico Letta to report on the Future of the Single Market. This report outlines what can be done to bolster Europe’s competitiveness by advocating for advancements in the EU’s R&D, investment, and production capabilities, (which includes also healthcare). This report likely influenced the drafting of the Council’s Strategic Agenda and will also likely influence the Commission’s Work Programme for 2025.

Looking forward, we expect imminent publication of a report (also tasked by the Commission) from (another) former Italian Prime Minister—Mario Draghi—on the Future of European Competitiveness. Although delayed, Draghi’s report is expected to influence the Commission’s Work Programme, in particular, in relation to the competitiveness of the EU life science industry (even if it arrives too late to influence the Council’s Strategic Agenda).

The current Commission continues to work, engaging with EU stakeholders to develop the Commission’s work programme for 2025. We anticipate a continued focus on innovation, with further developments under the Biotech Initiative (read our Quick Take here), as well as reviews of the Regulation on Serious Cross-Border Health Threats, potential revisions to the Regulation Extending the ECDC’s Mandate, a potential reopening of the Medical Devices legislation, and the first interim evaluation of the EU4Health programme.

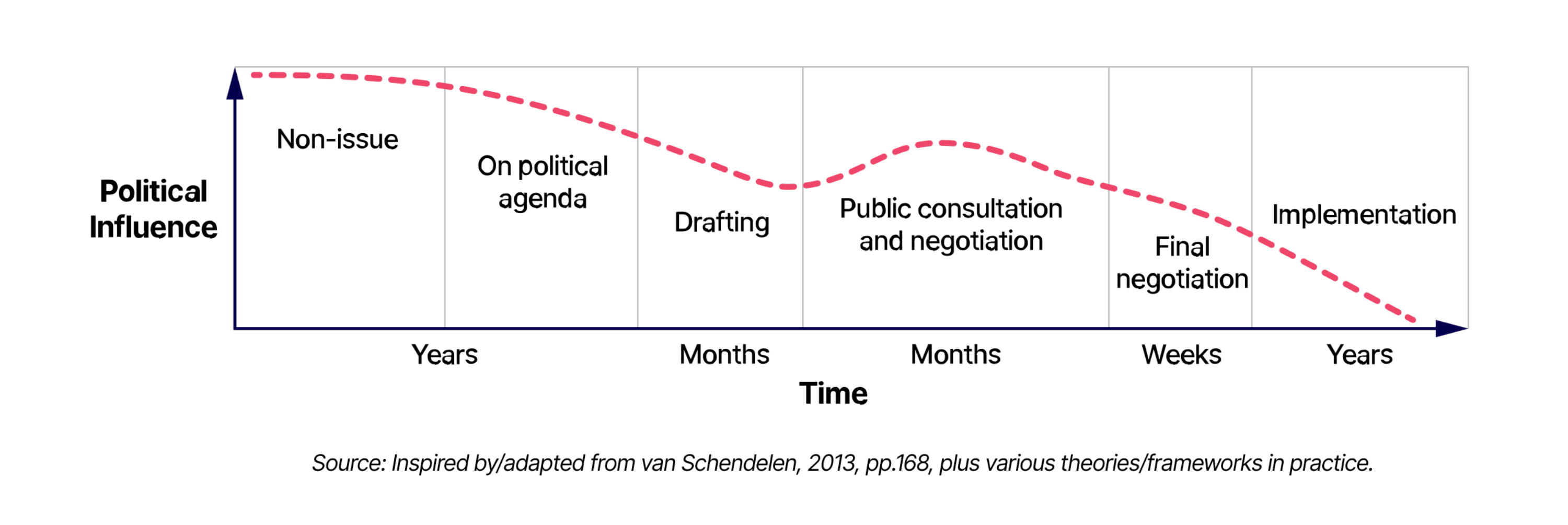

Life science leaders may wish to reflect on lessons learned from the recent mandate, for example, in relation to the Pharma Package. The most effective policy influencing takes place before there’s a concrete proposal on the table. To anticipate this, there’s a need for proactive horizon scanning, foresight activities, and monitoring of the policy landscape to help shape the agenda, rather than scrambling to change a proposal once it is out. Regular engagement between PA/GA functions and commercial and leadership functions is critical. This ensures that businesses are able to focus and allocate resources early enough to anticipate such developments, and avoid a higher cost and less effective campaign, “once the cat is already out of the bag.”

In a year of EU transition, in a changing political landscape, and with new faces in Brussels and beyond, navigating this environment effectively has never been more important. Life sciences companies can benefit from highly specialized EU public affairs and government relations advice to navigate these challenges successfully, ensuring business priorities are met.

With over 50 team members and a dedicated healthcare team, EGA Brussels has the experience and skills to help you navigate EU politics, policy, and the institutional transition—specifically in health. We connect your business priorities to the policies and politics of the European Union. For further information, please contact EGAʼs Health team at Jamie.Wilkinson@EdelmanEGA.com or Clara.Hervas@EdelmanEGA.com.